Vix Futures Expiration Calendar 2025-2026 – Additionally, there are about 7 times more open puts than open calls at the $19.00 strike price, with 3,513 open puts compared to 500 open calls. This reflects a pronounced bearish sentiment in the . 2-Year U.S. Treasury Note Continuous Contract $103.184-0.043-0.04% 5-Year U.S. Treasury Note Continuous Contract $108.750 0.109 0.10% 10-Year U.S. Treasury Note Continuous Contract $112.953 0.297 0.26 .

Vix Futures Expiration Calendar 2025-2026

Source : www.marketwatch.com

How the recent tax cuts and budget deal jack up the national debt

Source : www.marketwatch.com

Tech giants lead a big earnings week as markets grow cautious

Source : www.marketwatch.com

How the recent tax cuts and budget deal jack up the national debt

Source : www.marketwatch.com

A key Tesla metric is ‘under threat.’ Wall Street will soon learn

Source : www.marketwatch.com

I found the catalyst for the 2024 crash : r/StockMarket

Source : www.reddit.com

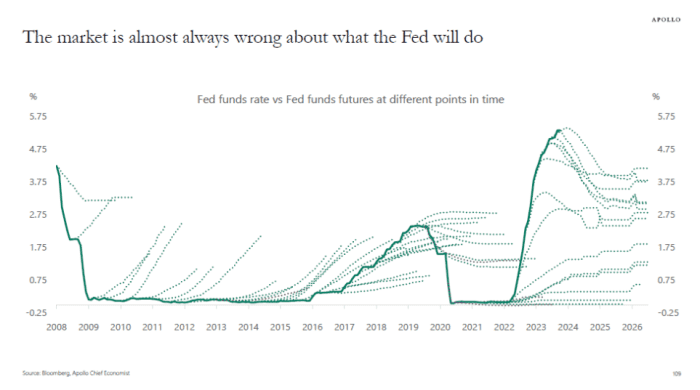

The market is almost always wrong about what the Fed will do next

Source : www.marketwatch.com

Market Volatility Bulletin | PDF | Vix | Derivative (Finance)

Source : www.scribd.com

Tesla downgraded to sell as UBS says the stock overvalues growth

Source : www.marketwatch.com

Market Volatility Bulletin | Download Free PDF | Option (Finance

Source : www.scribd.com

Vix Futures Expiration Calendar 2025-2026 The market is almost always wrong about what the Fed will do next : Changelly is bullish on Bitcoin for 2025, predicting an average price of $100,260 and a maximum price of nearly $114,049, which is more than double current price. CoinPedia and CoinCodex are also . According to AMBCrypto’s analysis, Pepe’s price would be trading at an average of $0.0000059. In 2025, CoinPedia believes that PEPE could go as high as $0.00000731823 level. Changelly is more .